Calculate hourly rate for semi monthly payroll

A semi-monthly pay schedule for hourly employees might be on the 7th and the 22nd of the month for hours worked from the 16th to the end of the month and the 1st to the 15th respectively. This California hourly paycheck calculator is perfect for those who are paid on an hourly basis.

What Is A Pay Period How Are Pay Periods Determined Ontheclock

Federal Payroll Tax Payment Frequency.

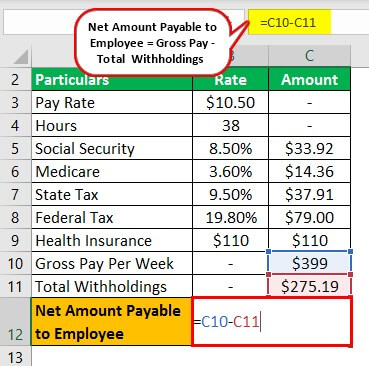

. Dont want to calculate this by hand. Subtract any deductions and payroll taxes from the gross pay to get net pay. You calculate gross wages differently for salaried and hourly employees.

To calculate an hourly employees gross wages for a pay period multiply their hourly pay rate by their number of hours worked. Why Gusto Payroll and more. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The PaycheckCity salary calculator will do the calculating for you. Calculating the Semi monthly pay of a salaried employee. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida. The Florida Reemployment Tax minimum rate for 20221 is 0129 and can be. The semi-monthly salary of a salaried employee can be calculated in a very simple manner.

Firstly you need to know the annual salary of the employee. Let us assume that an employee earns a gross of 100000 annually. Consultants can also use this salary calculator to convert hourly rate to salary or annual income.

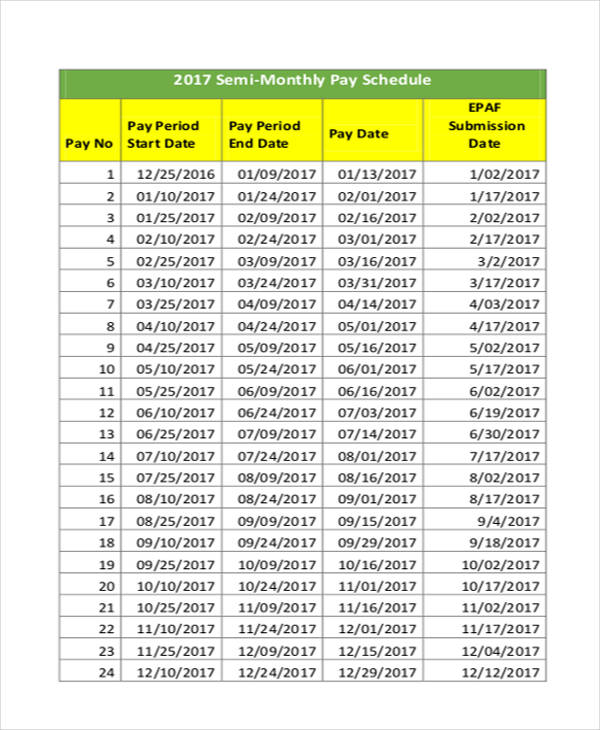

Convert a salary stated in one periodic term hourly weekly etc into its equivalent stated in all other common periodic terms. There are 26 pay periods. Now we already know that a semi-monthly payment regime has 24 pay periods.

If employees are paid semi-monthly there are 24 pay periods. This number is the gross pay per pay period. Break down your wage into hourly monthly or annual income and more.

Large organizations might also have internal deadlines for time sheet submission between the end of the pay period and the pay day. Switch to California salary calculator. How to Use This Salary Calculator.

And if employees are paid once a month there are.

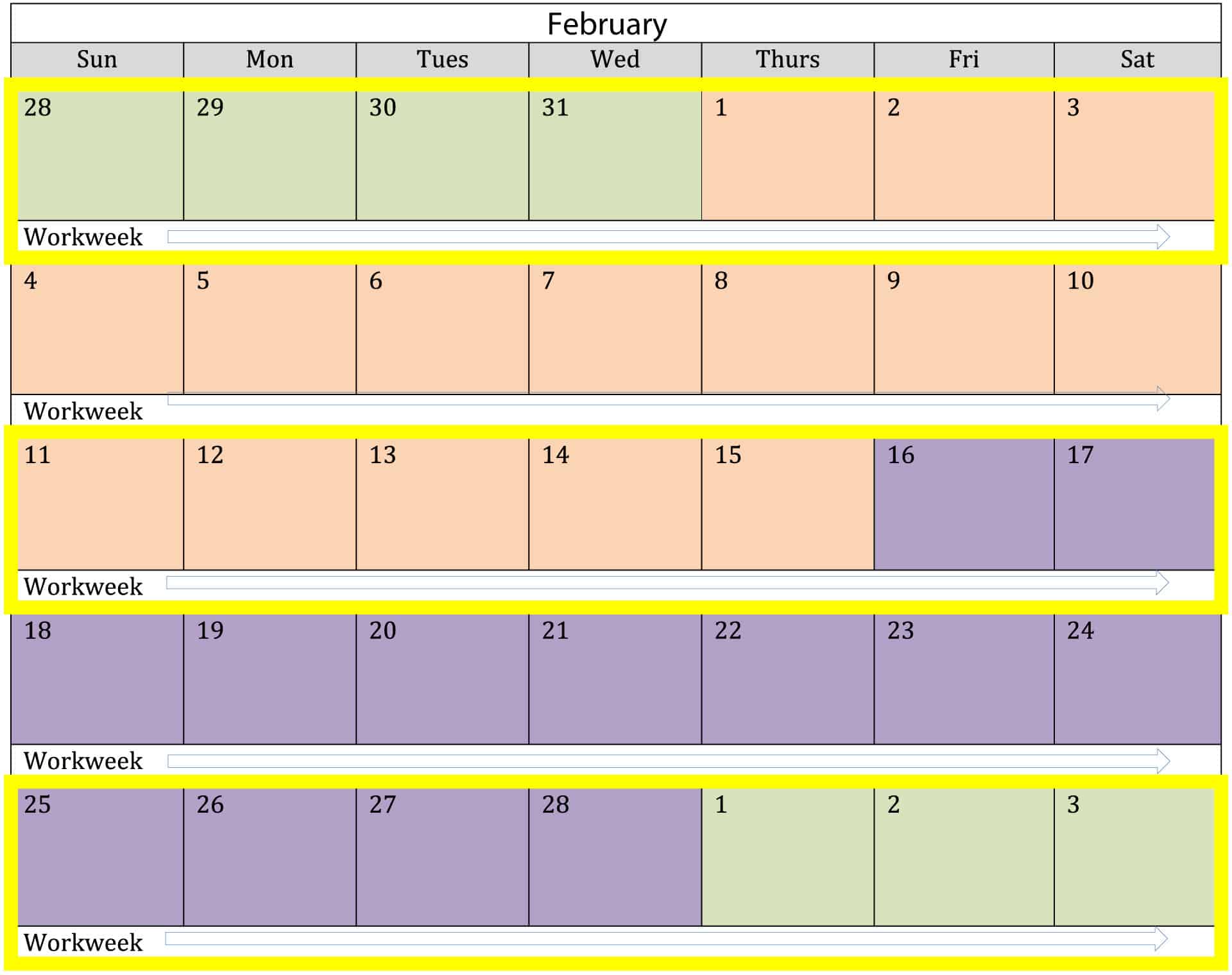

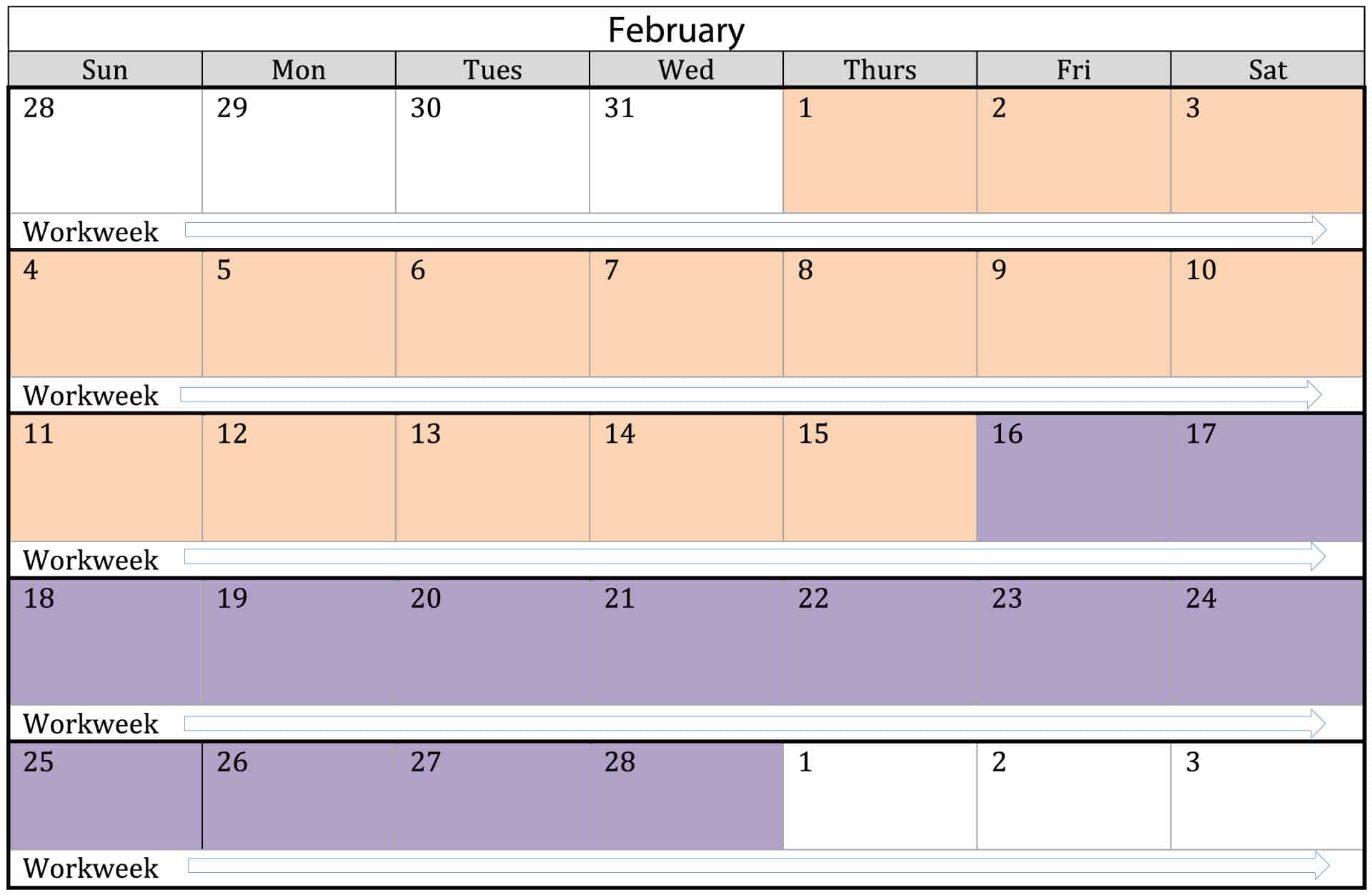

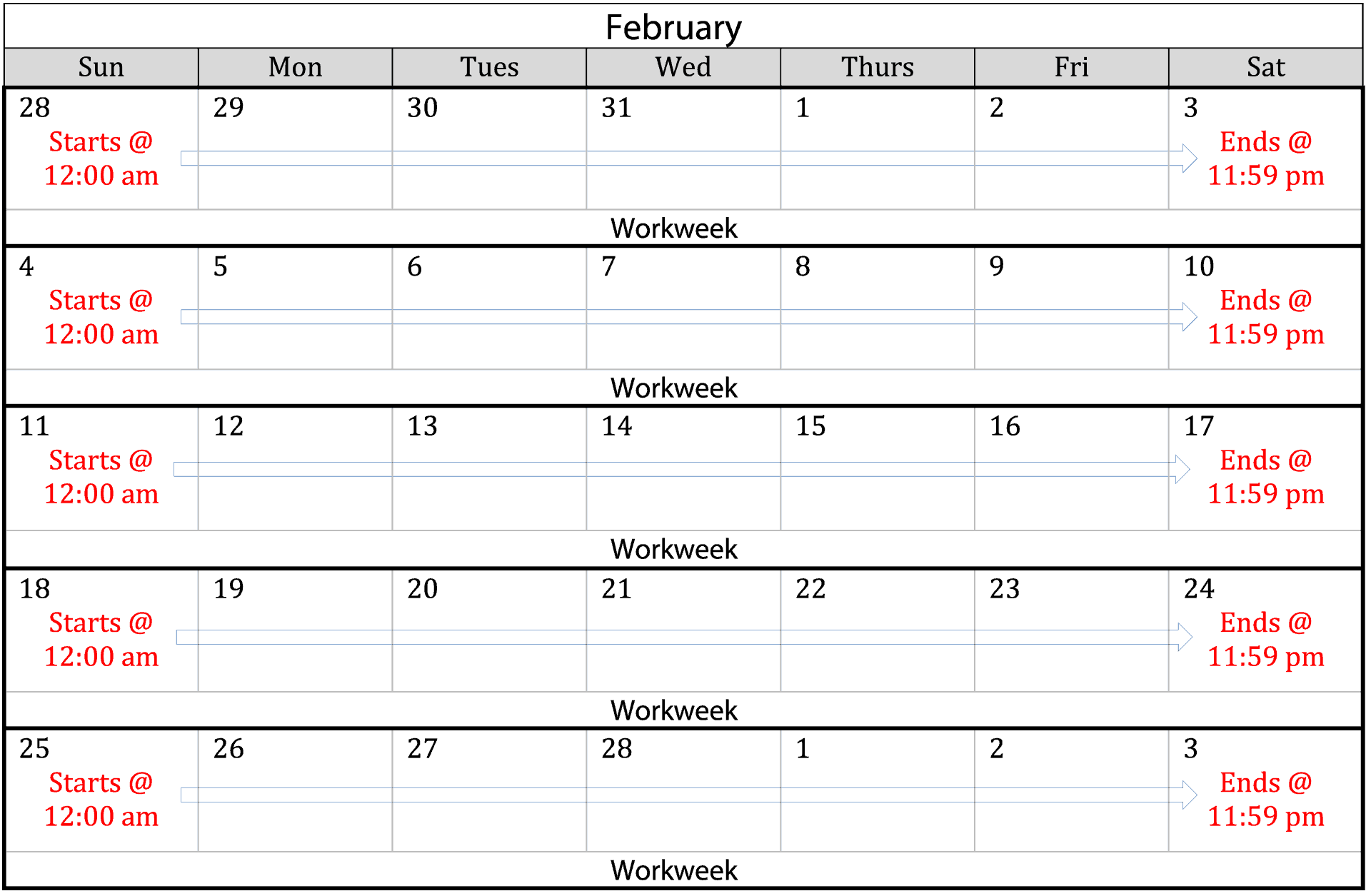

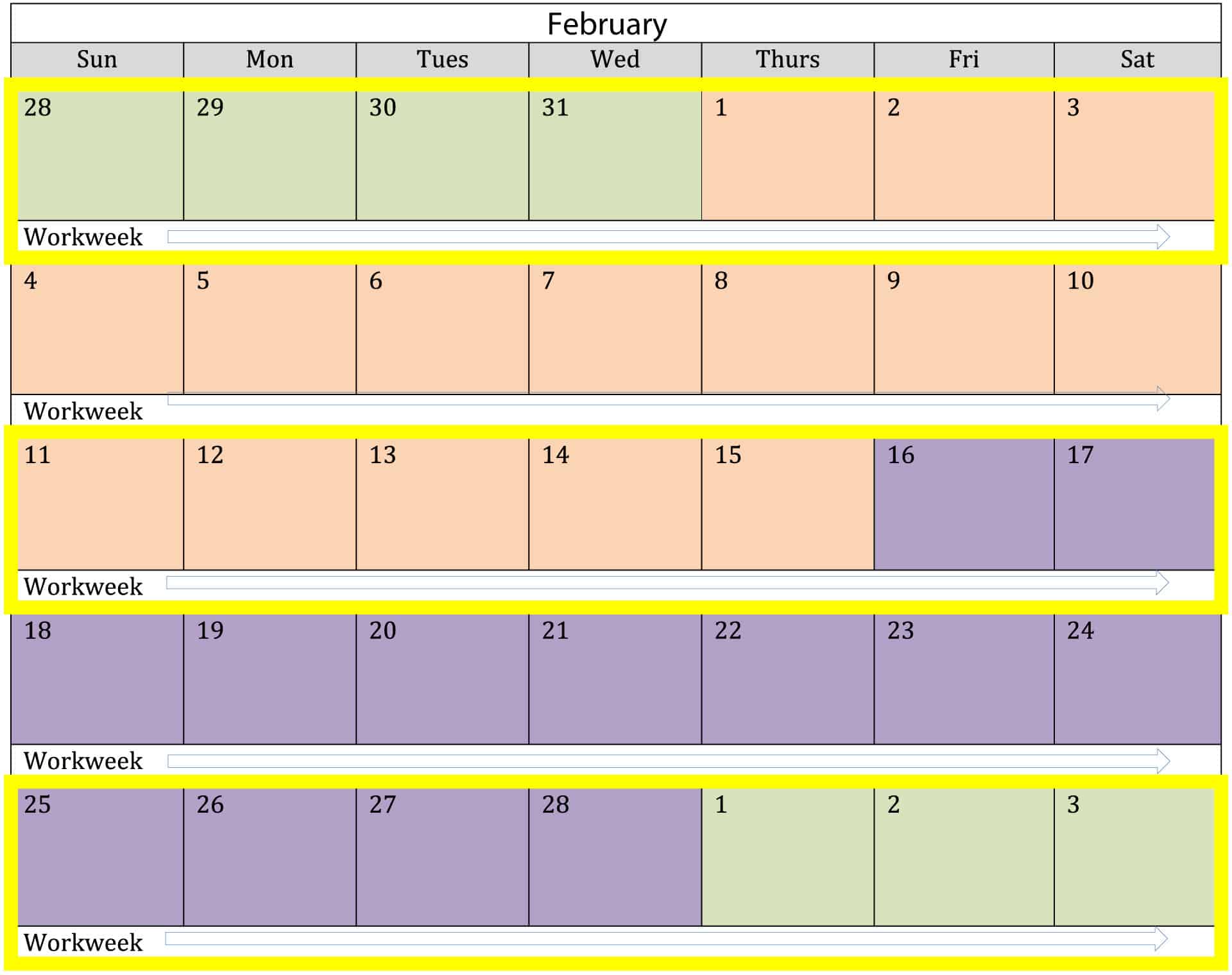

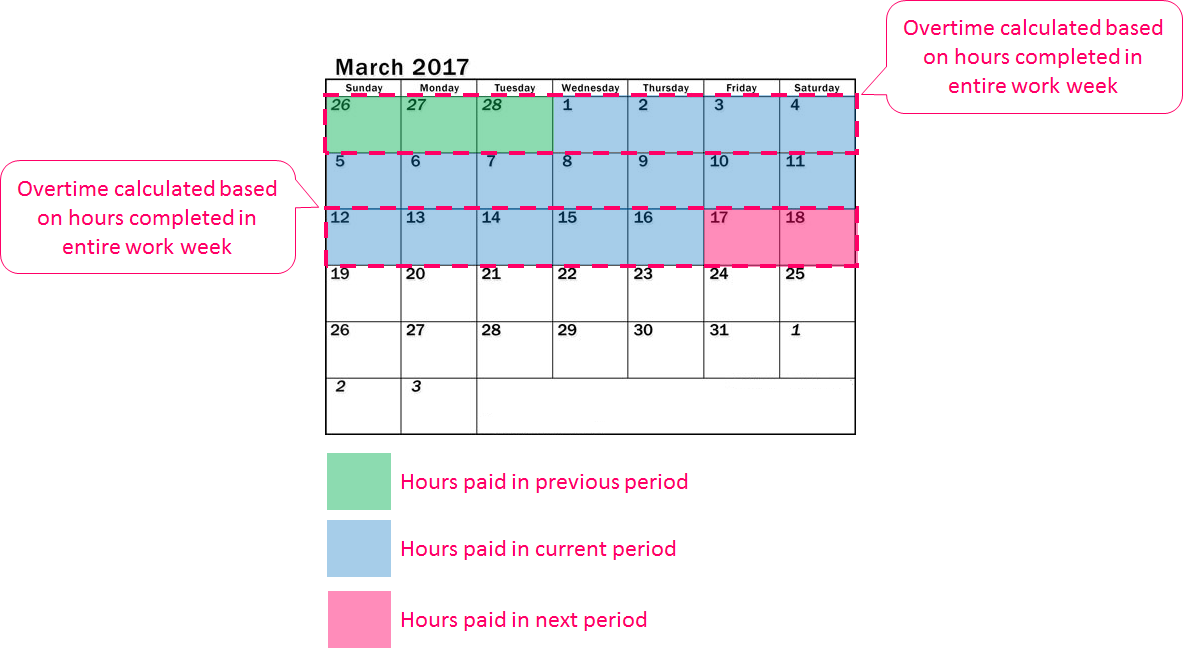

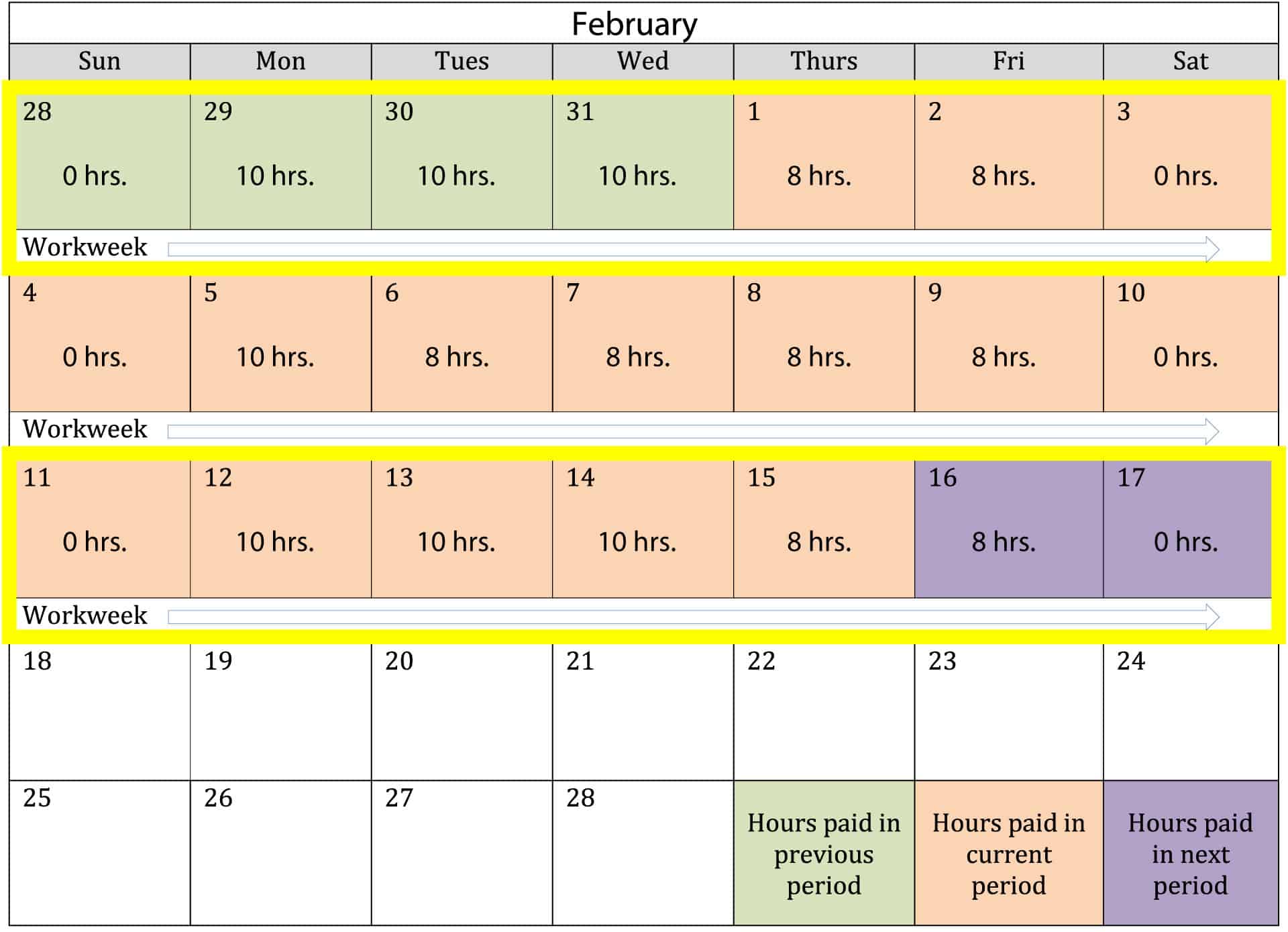

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

4 Ways To Calculate Annual Salary Wikihow

9 Payroll Schedule Templates Word Docs Free Premium Templates

Prorated Salary Easy Guide Calculator Hourly Inc

Semi Monthly Pay Period Timesheet Mobile

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

![]()

Download Free Bi Weekly Timesheet Template Replicon

Payroll Formula Step By Step Calculation With Examples

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Difference Between Bi Weekly And Semi Monthly Difference Between

What Is A Pay Period Types Considerations And How To Choose Netsuite

How To Calculate Pay Using The State Formula Rate Mit Human Resources

4 Ways To Calculate Annual Salary Wikihow

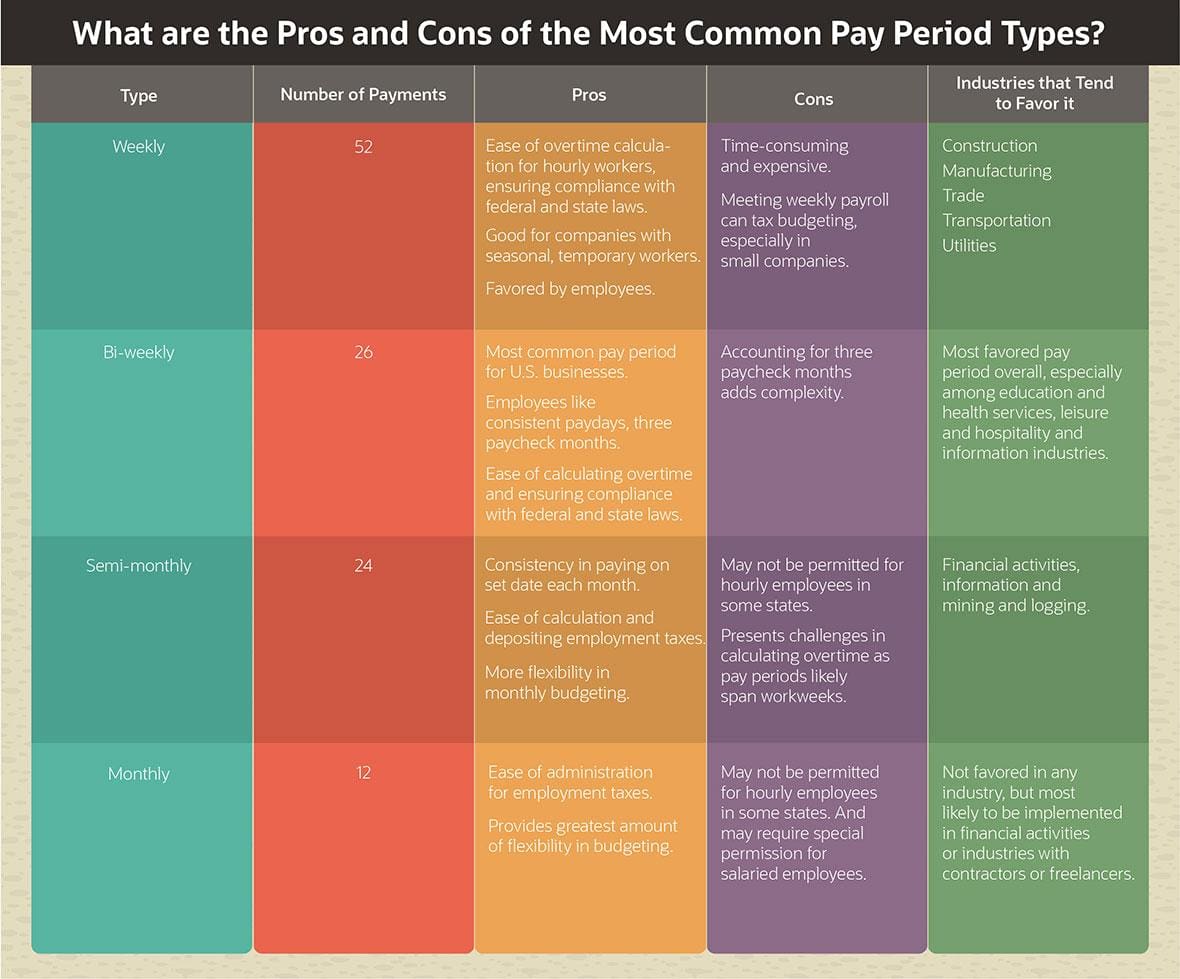

The Pros And Cons Biweekly Vs Semimonthly Payroll