30+ deduct home mortgage interest

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Homeowners with a mortgage that went into effect before Dec.

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Web 23 hours agoAlthough rates are down from their 737 peak the 30-year fixed mortgage rate came in at 657 on Monday.

. Our Trusted Reviews Help You Make A More Informed Refi Decision. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web 8 hours agoThe 30-year fixed-mortgage rate average is 694 which is a decline of 14 basis points compared to one week ago.

In a 52-week span the lowest rate was 456 while the. Check Out Our Rates Comparison Chart Before You Decide. Web If youve closed on a mortgage on or after Jan.

Web Here is an example of what will be the scenario to some people. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Thats down from a rate of 676 on Friday.

If you are single or married and. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who bought houses before.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Most homeowners can deduct all of their mortgage interest. In the year you.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web 8 hours agoTodays average rate on a 30-year fixed-rate mortgage is 698 which is 016 lower than last week. 5 Lowest Mortgage Refinance Rates Are Now Available In The US. According to Goldman Sachs 99 of borrowers.

Web So if you were dutifully paying your property taxes up to the point when you sold your home you can deduct the amount you paid in property taxes last year up to. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. A basis point is equivalent to 001 The most. Web The Tax Cuts and Jobs Act TCJA of 2017 reduced the maximum mortgage principal eligible for the interest deduction to 750000 from 1 million.

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Our Trusted Reviews Help You Make A More Informed Refi Decision.

Ad Looking For a Mortgage Refinance. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Tax break 1.

Web 1 day agoThe average rate on the popular 30-year fixed mortgage dropped to 657 on Monday according to Mortgage News Daily. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. 15 2017 can deduct interest on loans up to 1 million.

Web A home mortgage interest deduction is a tax deduction that helps homeowners reduce their federal tax returns by claiming interest paid on home. Web You already had a mortgage or loan and increased it on or after 1 January 2013For the original loan you are entitled to deduct mortgage interest for a maximum. 750000 if the loan was finalized.

If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be.

If Your Ctc Is Rs 40 Lpa What Do You Take Home After Taxes And Other Deductions Quora

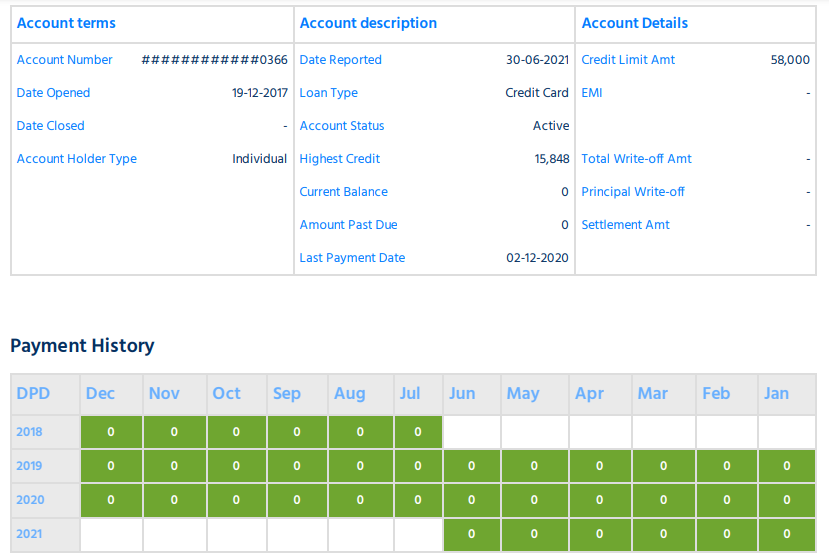

What Is Days Past Due Dpd In Cibil Report Cibil Dpd Format

Buy Your Home To Avail Additional Deduction U S 24b In Ay 2020 21

What Is The Average Wage Of Engineers In Germany Quora

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Prices Dip For First Time Off Crazy Spike Price Reductions Surge Sellers Emerge House Sales Drop Year Over Year Inventories Supply Keep Rising Wolf Street

Calculating The Home Mortgage Interest Deduction Hmid

How To Claim Rs 1 5 Lakhs Home Loan Interest Deduction U S 80eea Under The Affordable Housing Scheme In 2021 22

Westpac Nz Economists Raise Their Forecast Ocr Peak By 50 Basis Points Interest Co Nz

Maximizing Linkages A Policymaker S Guide To Data Sharing Digital Benefits Hub

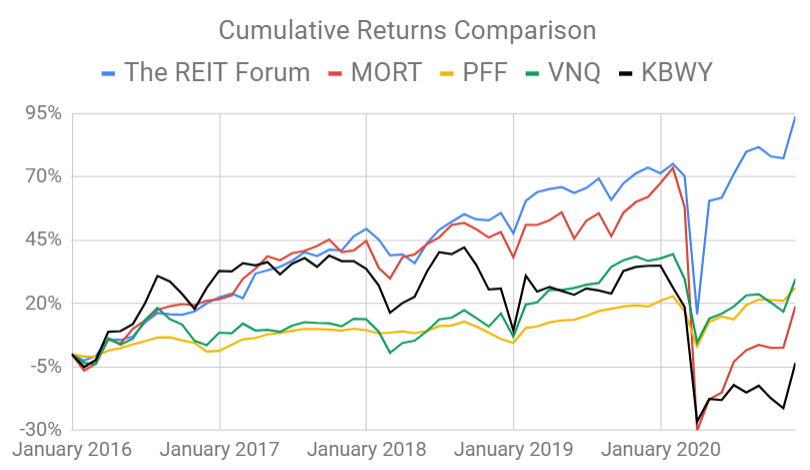

Lessons On Floating Rate Preferred Shares Seeking Alpha

Fixed Rate Mortgage Wikipedia

The Home Mortgage Interest Deduction Lendingtree

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction Bankrate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service